A favorite line of criticism of Wal-Mart detractors is that the firm does not provide benefits for its employees. Especially egregious in their eyes is that Wal-Mart pushes health care costs onto the general taxpayer, which, aside from being callous and exploitive of its employees, burdens the taxpayer and gives the firm an unfair advantage over other firms that allegedly do not engage in this practice.I will now amplify some of Vedder and Cox's points with some real world data.

While complete data are not available to analyze this criticism fully, limited information suggest that the charges are largely without merit. First of all, the notion that "Wal-Mart does not provide health care benefits" is simply fallacious. As of late 2005, the company was insuring nearly a million people, including 568,000 employees. While these plans require payments by individuals, they are heavily subsidized by the company.

One might note that Wal-Mart has a total of well over one million domestic employees, so it is true that less than one-half (slightly over 43 percent by our calculations) receive health benefits from the company. These statistics, however, are similar to those for American industry as a whole. While the proportion of all workers in private industry receiving health care benefits is slightly higher (53 percent), the proportion with wages of less than $15 an hour having such benefits is less (39 percent).

Not only is Wal-Mart not markedly different from typical employers of low-wage workers regarding health insurance, but it is extremely unlikely that a majority of its employees are, in fact, dependent on Medicaid, as some critics claim. Large numbers of employees are part-time workers who are seldom insured by employers, even in the public sector. Many, if not most, of these employees are secondary earners in households where a spouse or parent has family health insurance coverage. Some older Wal-Mart employees work at the company part-time to supplement pension income and are part of the Medicare program to which they contributed through their taxes before retirement (and also now while working at Wal-Mart). One study estimates that over 90 percent of Wal-Mart workers are insured in some manner.

Is it possible that some part-time Wal-Mart employees have such low incomes that they receive Medicaid? Of course it is, just as it is true for workers at Target, in hospitality businesses (where average wages are lower than at Wal-Mart), and for a host of other employments. But it seems unlikely that the proportion of Wal-Mart employees receiving Medicaid is as high as the proportion of Medicaid recipients in the total U.S. population (15-20 percent).

These statistics, however, are similar to those for American industry as a whole

The following information is extracted from "Wal-Mart: A Progressive Success Story," by Jason Furman, former Director of Economic Policy for the Kerry-Edwards 2004 campaign.

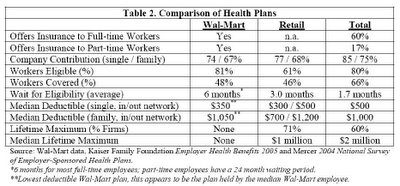

Wal-Mart’s health benefits are similar to or better than benefits at comparable employers. Some key comparisons are summarized in Table 2. (click to view larger version)Not only is Wal-Mart not markedly different from typical employers of low-wage workers regarding health insurance, but it is extremely unlikely that a majority of its employees are, in fact, dependent on Medicaid

Wal-Mart is relatively unusual in that it offers health insurance both to full- and part-time employees. By comparison, only 60 percent of firms economywide offer health benefits and only 17 percent of firms offer health benefits to part-time workers. Target, for example, does not offer benefits to people working less than 20 hours per week. Wal-Mart, however, has longer waiting periods for eligibility for benefits than many other firms, 6 months for full-time workers and 24 months for part-time workers.

Wal-Mart pays about 70 percent of the cost of health benefits, similar to the retail industry and somewhat below the national average.

Substantially more Wal-Mart employees are eligible for health insurance than in the retail sector as a whole and even slightly more than the nationwide total. Wal-Mart employees, however, are less likely to take up their health insurance.

As a result, 48 percent of Wal-Mart’s workers have health insurance, compared to 46 percent in the retail industry as a whole. Dube and Wertheim find similar results. They adjust health coverage to match Wal-Mart’s geography and find that 45 percent of retail employees and 53 percent of large retail employees have employer-sponsored health insurance. The retail industry has lower employer-sponsored health insurance than the economy as a whole, a fact that reflects the generally lower compensation in the retail sector and the greater likelihood that a retail employee will be covered through a spouse’s more generous employer-sponsored policy.

To quote again from Furman:

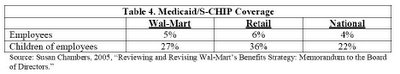

In total, as shown in Table 4, 5 percent of Wal-Mart employees are on Medicaid, which is similar to the percentage for other large retailers and is comparable to the national average of 4 percent. The children of Wal-Mart employees receive Medicaid and S-CHIP slightly less often than the retail sector as a whole and slightly more than the national average. The fraction of children is relatively large, reflecting the expansion of public health coverage for children in low- and moderate-income families. The fact that Wal-Mart employees top the Medicaid rolls in a number of states is simply a reflection of Wal-Mart’s enormous size, not the higher likelihood that its employees will be on Medicaid.Large numbers of employees are part-time workers who are seldom insured by employers, even in the public sector According to a February 14, 2006 Lewiston Tribune article, the Washington State government had about the same number of workers (3,127) benefitting from Medicaid as Wal-Mart did in Washington in 2004. More than 14,400 local government workers or their dependents were on Medicaid. That's nearly five times the amount of Wal-Mart employees on Medicaid. For example, WSU employees that work less than 20 hours a week do not received health care benefits.

Of course it is, just as it is true for workers at Target, in hospitality businesses (where average wages are lower than at Wal-Mart), and for a host of other employments

This graphic appeared in a January 2007 Seattle Times report based on a leaked confidential state report:

Wal-Mart leads the list, as it is by far the largest retail employer in the state of Washington. But when you look at percentages of employees on Medicaid, Target fares just as badly. With around 6,200 employees, 814 employees on Medicaid represents some 13% of Washington Target employees. And the state numbers with respect to Wal-Mart are highly suspect to begin with. A report from three years earlier indicated only 450 Wal-Mart employees were receiving Medicaid benefits. That was nearly a tenfold increase. Seems a bit fishy, especially as this report was leaked was right before Queen Christine's ill-fated attempt to pay back the unions by requiring Wal-Mart and virtually Wal-Mart alone to contribute more to employees' health care costs.

A 2005 study by Dr. Michael Hicks reported that only 2.3% of Washington Wal-Mart employees were on Medicaid, the lowest number in the country.

Technorati Tags: wal-mart walmart

No comments:

Post a Comment