Wal-Mart’s health benefits are similar to or better than benefits at comparable employers. Some key comparisons are summarized in Table 2. (click to view larger version)It should be noted since this paper was written that Wal-Mart has reduced the wait time for part-time employees from 24 months to 12 months. So what about Costco then?Wal-Mart is relatively unusual in that it offers health insurance both to full- and part-time employees. By comparison, only 60 percent of firms economywide offer health benefits and only 17 percent of firms offer health benefits to part-time workers. Target, for example, does not offer benefits to people working less than 20 hours per week. Wal-Mart, however, has longer waiting periods for eligibility for benefits than many other firms, 6 months for full-time workers and 24 months for part-time workers.

Wal-Mart pays about 70 percent of the cost of health benefits, similar to the retail industry and somewhat below the national average.

Substantially more Wal-Mart employees are eligible for health insurance than in the retail sector as a whole and even slightly more than the nationwide total. Wal-Mart employees, however, are less likely to take up their health insurance.

As a result, 48 percent of Wal-Mart’s workers have health insurance, compared to 46 percent in the retail industry as a whole. Dube and Wertheim find similar results. They adjust health coverage to match Wal-Mart’s geography and find that 45 percent of retail employees and 53 percent of large retail employees have employer-sponsored health insurance. The retail industry has lower employer-sponsored health insurance than the economy as a whole, a fact that reflects the generally lower compensation in the retail sector and the greater likelihood that a retail employee will be covered through a spouse’s more generous employer-sponsored policy.

Wal-Mart reports that 548,000 of its employees have health insurance, covering a total of 948,000 people. Some 34 percent of Wal-Mart employees are offered health insurance but choose not to enroll, either because they are covered through another family member, prefer to be on Medicaid than pay the premium, or choose not to have health insurance.

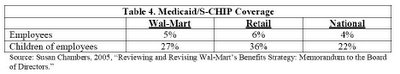

In total, as shown in Table 4, 5 percent of Wal-Mart employees are on Medicaid, which is similar to the percentage for other large retailers and is comparable to the national average of 4 percent. The children of Wal-Mart employees receive Medicaid and S-CHIP slightly less often than the retail sector as a whole and slightly more than the national average. The fraction of children is relatively large, reflecting the expansion of public health coverage for children in low- and moderate-income families. The fact that Wal-Mart employees top the Medicaid rolls in a number of states is simply a reflection of Wal-Mart’s enormous size, not the higher likelihood that its employees will be on Medicaid.

The Costco model is largely irrelevant for Wal-Mart. Costco shoppers have an average income of $74,000, which is twice the $35,000 average income for Wal-Mart shoppers (Target is in the middle with average incomes of $50,000 per shopping family). Costco is primarily in or near urban areas and is, among other facts, the country’s leading seller of fine wines. The Chairman of Costco, Jeff Brotman, described its target customer to Fortune: “We understood that small-business owners, as a rule, are the wealthiest people in a community… So they would not only spend significant money on their businesses, they’d spend a lot on themselves if you gave them quality and value.” Fortune goes on to explain, “What Costco has come to stand for is a retail segment where high-end products meet deep-discount prices…. they’ve redefined discounting. Time was when only the great unwashed shopped at off-price stores. But warehouse clubs attracted a breed of urban sophisticates – detractors would call them yuppie scum – attuned to what retail consultant Michael Silverstein calls the ‘new luxury.’”Finally, "Moscow at Tipping Point" give us some local Wal-Mart health plan info:

As a result of higher margin goods and larger volumes, sales per employee are considerably larger at Costco. This enables it to be more generous with its employees, helping it to attract the more skilled and experienced workers that its higher-income customers expect. This is a reasonable business model; it just isn’t Wal-Mart’s. Telling Wal-Mart to ape Costco’s wages is like telling Best Buy it should pay its employees as much as the high-end boutique plasma television dealer across the street.

Technorati Tags: wal-mart walmart

No comments:

Post a Comment