Universal healthcare provided by the government that gaves us the $500 toilet seat and the $250 hammers No thanks, Daily Watermelon. I'll take "Free Market Health Care Solutions" for $1 billion, Alex.

Since launching the $4 prescription program in September 2006, Wal-Mart customers in Washington have saved $11,487,959.73.

The $4 Program provides a solution for the nearly 800,000 uninsured Washington residents (according to the Kaiser Family Foundation) who may may presently avoid filling prescriptions and remain untreated. Nationwide the savings have amounted to more than $1 billion as of March 10.

That's a lot "sickos" treated, eh fatso?

Technorati Tags: wal-mart walmart

Politics from the Palouse to Puget Sound

Showing posts with label Health Care Crisis. Show all posts

Showing posts with label Health Care Crisis. Show all posts

Thursday, March 20, 2008

Saturday, July 14, 2007

Who's To Blame for Health Care Crisis?

According to a new study by the Idaho Office of Performance Evaluations and the Mathematica Policy Research Group, it's not who we are always told by our local intelligentsia:

From yesterday's Idaho Statesman:

See, our latte liberals either ignore or are willfully ignorant of the politically incorrect truth. Small businesses are an integral part of our economy and represent the ultimate realization of free enterprise and the American Dream. But let's face it. A worker at Wal-Mart is going to have much better wages and benefits than a worker at a small, trendy "boutique" store.

As Michael O'Neal pointed out so well the other day, wealthy leftists have to assuage their guilty consciences somehow, so their snobbish disdain of "cheap Chinese crap" gets whitewashed with the false rubric of "worker's rights."

Technorati Tags: wal-mart walmart

From yesterday's Idaho Statesman:

Mathematica researcher Lynn Taylor explained one reason Idaho is unique. About 40 percent of all Idaho workers are employed by businesses with fewer than 50 employees — far more than the national average of 29 percent. Small businesses are less likely than big ones to be able to afford health insurance.What's this????? We are regaled with letters to the editor on a weekly basis singing the praises of small business over the evil, ugly big boxes, and it turns out that small business is responsible for many people not having health insurance in Idaho?

See, our latte liberals either ignore or are willfully ignorant of the politically incorrect truth. Small businesses are an integral part of our economy and represent the ultimate realization of free enterprise and the American Dream. But let's face it. A worker at Wal-Mart is going to have much better wages and benefits than a worker at a small, trendy "boutique" store.

As Michael O'Neal pointed out so well the other day, wealthy leftists have to assuage their guilty consciences somehow, so their snobbish disdain of "cheap Chinese crap" gets whitewashed with the false rubric of "worker's rights."

Technorati Tags: wal-mart walmart

Wednesday, May 16, 2007

Free-Market Health Care and Wal-Mart, Part II

From the May 13 edition of Florida Today:

HT: Marshall Manson

$4 pricing makes more medicine affordableTechnorati Tags: wal-mart walmart

Before Wal-Mart and Target decided to sell hundreds of generic prescription drugs for a flat $4 fee in September, Ann Maynard couldn't afford to take the medications her doctor prescribed.

"I went, 'Whoa!' " she said, describing her reaction when she realized what the new policy would mean to her life.

"If it wasn't for this new trend, I would still be walking around unmedicated. What they're doing is causing everyone to follow them," she said.

It has been about nine months since the discount-store giants Wal-Mart and Target decided to take on the drug industry by undercutting most of their competitors. The result has made many medicines affordable to the elderly, working poor and uninsured.

Experts say it might be too early to gauge the overall effect on the drug industry and consumers. Pharmacy chains -- which dominate sales -- say the move hasn't affected their business.

Sandy Lutz, director of the Health Research Institute with PricewaterhouseCoopers, said growth in drug spending is slowing down, as people move to using more generic drugs in general.

"Drug spending is going up, but not as quickly as in the past," Lutz said. "Part of that is generics and these types of pricing" from Wal-Mart and Target.

According to the National Association of Chain Drug Stores, doctors wrote about 3.38 billion prescriptions in the U.S. in 2005, costing consumers $230.3 billion. That was an increase of 110 million prescriptions and $10.2 billion over 2004.

About 41 percent of those prescriptions were filled at chain drugstores, while mass merchants like Wal-Mart and Target accounted for nearly 10 percent.

Experts say health-care providers were becoming sensitive to pricing, even before the $4 generic-drug programs went into effect.

"People overall are becoming much more aware of what health-care services and products cost," Lutz said. "It's partly because of consumer-directed access, high deductibles and industry efforts to be more transparent. It's good for consumers to see what things cost."

'Overpriced' brands

With the move to $4 generic drugs, some consumers have left traditional drugstores, and headed down the street to Wal-Mart and Target.

"Branded prescriptions are extremely overpriced," said Viera resident Dee Rustic, who was picking up an anticoagulant for her husband recently at Target.

"It's very, very difficult for people, especially on a fixed income, to take as many as 10 drugs. I think this type of program makes it easy for people to take the drugs they need," she said.

Rustic, who worked as a nurse-practitioner in Michigan and is looking for a job here, said she saw patients who didn't take blood-pressure medicine because they couldn't afford it.

"Patients need to ask their doctors to prescribe generics," she said.

Drugstores busy

But officials of drugstore giants Walgreen Co. and CVS/Caremark Corp. said the move by Wal-Mart and Target has not affected them.

Walgreen said generic-drug costs don't change costs for the majority of its customers, because those customers' insurance companies pay for the medications. In addition, Walgreen customers use other benefits at the stores, like 24-hour service and drive-through pharmacies.

CVS spokesman Mike DeAngelis agreed.

"For customers who have prescription coverage, the average generic co-pay is relatively nominal," DeAngelis said. "For example, the generic co-pay for Medicare prescription-drug plans is typically $5. Furthermore, under many health plans, the price paid by the consumer for some of these drugs is actually less than $4."

DeAngelis said his company's pharmacy sales were up 9 percent for the year, despite the Wal-Mart and Target generic-drug promotion.

New business

However, Wal-Mart and Target's customers are coming from somewhere.

"Response to the $4 prescription program has been considerable," Wal-Mart spokeswoman Jami Arms said. "Between Sept. 21 and Nov. 12, as the first 27 states were added to the program, 2.1 million new prescriptions were filled in those states, as compared to the same period" the year before.

Maynard, 51, takes medicine for high blood pressure, allergies and an occasional bout of depression.

Despite the fact that she works in an office for several doctors, she doesn't have health insurance.

Her antidepressant alone was $82. The total cost for her three prescriptions now is $12 a month.

"My doctor reviews the list before he prescribes to try and make sure that what I need can be found on Wal-Mart's generic list," she said.

Political angles

Chris Kofinis, a spokesman for the anti-Wal-Mart group WakeupWalmart.com, is among critics who think the list of $4 generics has too many drugs that aren't often prescribed. He said he thinks the move was part of Wal-Mart's political agenda to push government-paid health care.

"There's nothing wrong with cheap drugs," Kofinis said. "They're trying to deflect attention from the health-care crisis in their stores. That doesn't excuse your company not providing health care to 775,000 of its employees."

At least one expert said Wal-Mart's move is going to will have ramifications in Washington, D.C.

"Wal-Mart's push for universal health care lends more heft to the debate," said University of Arkansas associate professor Glen Mays, who studies the corporate giant, which is based in his state.

"It makes it a much more serious dialogue when you've got large corporations like that who are coming to the table," he said.

HT: Marshall Manson

Monday, May 14, 2007

Free-Market Health Care and Wal-Mart, Part 1

From the May 14, 2007 edition of the Wall Street Journal :

HT: Marshall Manson

It's Friday evening and you suspect that your child might have strep throat or a worsening ear infection. Do you bundle him up and wait half the night in an emergency room? Or do you suffer through the weekend and hope that you can get an appointment with your pediatrician on Monday -- taking time off your job to drive across town for another wait in the doctor's office?Technorati Tags: wal-mart walmart

Every parent has faced this dilemma. But now there are new options, courtesy of the competitive marketplace. You might instead be able to take a quick trip on Friday night to a RediClinic in the nearby Wal-Mart or a MinuteClinic at CVS, where you will be seen by a nurse practitioner within 15 minutes, most likely getting a prescription that you can have filled right there. Cost of the visit? Generally between $40 and $60.

These new retail health clinics are opening in big box stores and local pharmacies around the country to treat common maladies at prices lower than a typical doctor's visit and much lower than the emergency room. No appointment necessary. Open daytime, evenings and weekends. Most take insurance.

Much like the response to Hurricane Katrina, private companies are far ahead of the government in answering Americans' needs, this time for more accessible and more affordable health care. Political leaders across the country seeking to expand government's role in health care should take note.

Thousands of free-standing primary care clinics have been operating for years in malls and main streets around the country, often staffed by physicians and many offering a broad range of health services. The retail health clinics are creating a new model with more limited services at lower prices and almost always staffed by nurses. The Convenient Care Association estimates there are about 325 of these retail clinics operating nationwide today. Seventy-six of them are in Wal-Marts in 12 states, but the company announced last month it will expand to 400 clinics by the end of the decade and 2,000 in five to seven years. They will be run by outside firms, including for-profit ventures like RediClinic as well as local and regional health plans and hospitals.

The industry is rapidly expanding. You can find a MinuteClinic in the CVS on the Strip in Las Vegas. But you also will find many locally-run clinics in pharmacies and food stores across America, such as the Express Clinic in Miami, MediMin in Phoenix, and Curaquick in Sioux City, whose motto is "Get well soon."

Prices vary for services from flu shots ($15-$30), to care for allergies, poison ivy and pink eye ($50-$60), and tests for cholesterol, diabetes and pregnancy (less than $50). Competition already is starting to drive prices down.

Of all patients who have visited the clinics, almost half went there for a vaccination, and one-third received treatment for ear infections, colds, strep throat, skin rashes or sinus infections. Ninety percent said they were satisfied with the care they received. The nurses staffing the clinics are under physician supervision and follow strict protocols to refer patients to physicians or emergency rooms if problems are more serious.

Internists and family doctors are watching. Some see the clinics as useful in providing efficient care for a limited number of uncomplicated ailments, freeing physicians and hospitals to deal with more complex cases. But others are worried about lost business, fragmentation of care, and the quality of care if the clinics miss something serious.

Rick Kellerman, president of the American Academy of Family Physicians, concedes, "The retail clinics are sending physicians a message that our current model of care is not always easy to access." The threat of competition from the in-store clinics means some doctors are keeping their practices open later and on Saturdays and holding an hour open for same-day appointments. Competition works.

And competition also worked to force prescription drug prices down: When Wal-Mart announced last year that it was dropping the price of several hundred generic medicines to $4 for a month's supply, other pharmacies, from Target to corner drug stores, followed suit. Wal-Mart now says that a third of all prescriptions filled at its pharmacies are for the $4 generics, and 30% of them are filled by people without insurance.

Take note, Congress: The market is providing cheaper medicines, more affordable care -- and it is also helping the uninsured. A Harris Interactive poll conducted in March for The Wall Street Journal said that 22% of those visiting the clinics were uninsured. Wal-Mart says that half of its clinic visitors are uninsured.

Retail clinics are particularly attractive to 4.5 million people with Health Savings Accounts who have health insurance with higher deductibles and want an affordable option for some of their routine care.

And the clinics are working to solve another problem that is vexing Washington -- creation of electronic medical records. Most retail clinics create computerized patient records, with the goal of making the records accessible throughout the chain. The records also can be emailed to a hospital or to the patient's regular doctor -- or sent by fax if necessary.

Critics of engaging private competition in the health sector will argue that the vast majority of health-care dollars are spent on a relatively small percentage of patients with serious illness, especially those with multiple chronic conditions.

But even coordination of care for those with chronic illnesses lends itself to patient-friendly solutions. The City of Asheville, North Carolina, cut its costs in half for employees with diabetes by teaming up with local pharmacists who did routine exams and got patients to their doctors or hospitals more quickly when they needed intervention. Employees received their medicines for free if they kept appointments, and their health improved.

Because health care is largely regulated and licensed at the state level, some states are more friendly than others at having non-physicians deliver care. California requires that clinics be a medical corporation owned by a physician. In Arizona, each site must be licensed, but in most other states, a single license will serve multiple clinics. Illinois is considering legislation to limit the number of nurses a doctor could supervise to two and restrict the clinics' right to advertise.

This industry is in its infancy and will hardly register in our nation's $2 trillion-plus health care bill. But just as Nucor overturned the steelmaking industry with a faster-better-cheaper way of making low-end rebar, these limited service clinics could be the disruptive innovator in our health-care system. Package pricing for more complex treatments, like knee replacement surgery, may not be far behind.

Government can get in the way, of course, with protectionist policies that throw up more regulatory barriers to entry. But retail clinics could be just the beginning of consumer-friendly innovations, if Congress were to change tax policies in a way that would allow people to have more control over their health spending, as President Bush has proposed.

The linchpin is giving people the same tax benefits whether they get their health insurance at work or on their own, or buy coverage through groups like churches, labor unions and professional or trade associations. Allowing people to buy health insurance across state lines would inject another dose of healthy competition into the system.

With many congressional leaders hostile to free-market solutions, these policy changes are unlikely in the next two years. But as consumers get a taste of what consumer-friendly health care is like, they may well demand that the top-down, centralized health-care delivery of the 20th century give way to a system more in tune with the demands of 21st-century consumers seeking greater value and efficiency.

HT: Marshall Manson

Wednesday, May 02, 2007

"Dr. Sam"

This is dedicated to Pullman Chamber Guy and his comments earlier about Wal-Mart and free market health care.

From Investor's Business Daily, April 25, 2007 :

From Investor's Business Daily, April 25, 2007 :

Health Care: Medical costs got you down? Prescriptions too expensive? So fed up with our "system" that universal care is starting to look good by comparison? Before going that far, check what Wal-Mart's (NYSE:WMT) up to.Technorati Tags: wal-mart walmart

The retail colossus announced this week that it will open as many as 400 in-store medical clinics in the next two to three years. By 2014, it said, clinics could be in as many as half its 4,000 stores.

The announcement followed deep price cuts on prescription drugs introduced by the company last fall at 65 Tampa, Fla.-area outlets. That program, which was not beaten back like Wal-Mart's attempt to enter banking, has since spread across the country.

Wal-Mart's advance into health care is a testament to private-sector industriousness. While others whine about America's health care "crisis," and back monstrous government programs to solve it, Wal-Mart is actually making care more affordable.

Yes, the same Wal-Mart that politicians and activists demonize because its pay and benefits supposedly are insufficient.

The clinics will be operated by local hospitals or other independent professionals, and will particularly help the poor. Company executives say prices for medical care in the clinics will mirror the low prices in Wal-Mart stores.

Already, Wal-Mart has brought low-cost health care by selling 30-day supplies of more than 300 generic prescription drugs at some stores for $4. Almost a third of those $4 prescriptions are bought by the uninsured. Customers have saved $290 million through the program just since September

Cynics will say clinics and low-price drugs are a ploy to lure more shoppers into Wal-Mart. So? Is that wrong? The essential truth missing from their tirades about Wal-Mart's rapacity is that it's a company, not a charity. It must make a profit to stay in business, provide jobs and keep prices low.

If Wal-Mart thinks this latest plan will win the plaudits of its foes, it's mistaken. Just Tuesday, the United Food and Commercial Workers union, which runs a nonstop anti-Wal Mart campaign via the Web, derided the company's "disturbing" record on health care -- a laughable assertion, given Wal-Mart's record.

Opening clinics also will likely create new enemies: physicians and their staffs who fear that their practices will be harmed by the presence of price-cutting Wal-Mart clinics in their communities.

But the issue shouldn't be about saving local medical practices any more than saving local retailers who always complain when Wal-Mart moves in. It should be about quality health care -- and prescriptions, groceries, clothing and essential household items -- at prices all Americans can afford. Wal-Mart does that.

Labels:

Health Care Crisis,

Leftist Scumbags,

Liberalism,

Moonbattery,

Snobbish Hypocrisy,

Union Thugs,

Wal-Mart

Tuesday, May 01, 2007

Wal-Mart's Health Plan Versus the Retail Average

This is for Paul. In his paper "Wal-Mart: A Progressive Success Story," former Director of Economic Policy for the Kerry-Edwards 2004 Jason Furman compared Wal-Mart's health plan with other retailers.

Competitive medical benefits:75% of Moscow employees are covered directly with medical benefits (which is above the Wal-Mart national average coverage of 48%-55%). Most of the other 25% of Moscow Wal-Mart employees are likely covered on UI policies, spouse policies, or parent policies. In contrast employer based health insurance in the U.S. in 2004 covered only 54% of the U.S. population. Wal-Mart offers medical benefits to part-time workers versus 17% coverage by all firms nationwide.

Wal-Mart’s Competitive Benefit Package is comparable or even superior to the average retail trade firm in Moscow which includes paid vacation, a pension plan, disability insurance, and a variety of other benefits.

Technorati Tags: wal-mart walmart

Wal-Mart’s health benefits are similar to or better than benefits at comparable employers. Some key comparisons are summarized in Table 2. (click to view larger version)It should be noted since this paper was written that Wal-Mart has reduced the wait time for part-time employees from 24 months to 12 months. So what about Costco then?Wal-Mart is relatively unusual in that it offers health insurance both to full- and part-time employees. By comparison, only 60 percent of firms economywide offer health benefits and only 17 percent of firms offer health benefits to part-time workers. Target, for example, does not offer benefits to people working less than 20 hours per week. Wal-Mart, however, has longer waiting periods for eligibility for benefits than many other firms, 6 months for full-time workers and 24 months for part-time workers.

Wal-Mart pays about 70 percent of the cost of health benefits, similar to the retail industry and somewhat below the national average.

Substantially more Wal-Mart employees are eligible for health insurance than in the retail sector as a whole and even slightly more than the nationwide total. Wal-Mart employees, however, are less likely to take up their health insurance.

As a result, 48 percent of Wal-Mart’s workers have health insurance, compared to 46 percent in the retail industry as a whole. Dube and Wertheim find similar results. They adjust health coverage to match Wal-Mart’s geography and find that 45 percent of retail employees and 53 percent of large retail employees have employer-sponsored health insurance. The retail industry has lower employer-sponsored health insurance than the economy as a whole, a fact that reflects the generally lower compensation in the retail sector and the greater likelihood that a retail employee will be covered through a spouse’s more generous employer-sponsored policy.

Wal-Mart reports that 548,000 of its employees have health insurance, covering a total of 948,000 people. Some 34 percent of Wal-Mart employees are offered health insurance but choose not to enroll, either because they are covered through another family member, prefer to be on Medicaid than pay the premium, or choose not to have health insurance.

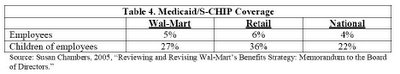

In total, as shown in Table 4, 5 percent of Wal-Mart employees are on Medicaid, which is similar to the percentage for other large retailers and is comparable to the national average of 4 percent. The children of Wal-Mart employees receive Medicaid and S-CHIP slightly less often than the retail sector as a whole and slightly more than the national average. The fraction of children is relatively large, reflecting the expansion of public health coverage for children in low- and moderate-income families. The fact that Wal-Mart employees top the Medicaid rolls in a number of states is simply a reflection of Wal-Mart’s enormous size, not the higher likelihood that its employees will be on Medicaid.

The Costco model is largely irrelevant for Wal-Mart. Costco shoppers have an average income of $74,000, which is twice the $35,000 average income for Wal-Mart shoppers (Target is in the middle with average incomes of $50,000 per shopping family). Costco is primarily in or near urban areas and is, among other facts, the country’s leading seller of fine wines. The Chairman of Costco, Jeff Brotman, described its target customer to Fortune: “We understood that small-business owners, as a rule, are the wealthiest people in a community… So they would not only spend significant money on their businesses, they’d spend a lot on themselves if you gave them quality and value.” Fortune goes on to explain, “What Costco has come to stand for is a retail segment where high-end products meet deep-discount prices…. they’ve redefined discounting. Time was when only the great unwashed shopped at off-price stores. But warehouse clubs attracted a breed of urban sophisticates – detractors would call them yuppie scum – attuned to what retail consultant Michael Silverstein calls the ‘new luxury.’”Finally, "Moscow at Tipping Point" give us some local Wal-Mart health plan info:

As a result of higher margin goods and larger volumes, sales per employee are considerably larger at Costco. This enables it to be more generous with its employees, helping it to attract the more skilled and experienced workers that its higher-income customers expect. This is a reasonable business model; it just isn’t Wal-Mart’s. Telling Wal-Mart to ape Costco’s wages is like telling Best Buy it should pay its employees as much as the high-end boutique plasma television dealer across the street.

Technorati Tags: wal-mart walmart

Subscribe to:

Posts (Atom)